Nick Winkler, Shopyfy

Nick Winkler, Shopyfy

Nick Winkler, Shopyfy

Nick Winkler, Shopyfy

The resurrection of commerce is happening all around us.

Cutting edge digitally native brands are experimenting with voice commerce, partnering with luxury Las Vegas hotels on exclusive pop-ups, and testing augmented reality-enabled online-to-offline (O2O) experiences. With headless commerce and progressive web applications (PWA), the world is becoming a storefront as brands enable commerce via smart mirrors, video games, and live streams.

Second and third tier shopping malls are being reborn as experiential destinations with theme parks, ski hills, and water slides. Legacy manufacturers and CPG companies are reinventing themselves by selling direct-to-consumer (DTC) to accelerate growth.

Yes, an estimated 12,000 retail locations were expected to close last year, But don't let the headlines skew your perspective—what dies in the mall is being reborn online, and what was born online is increasingly crossing over to the physical world..

Commerce is being raised from the dead online, offline, and everywhere in between. The future is bright, and is being shaped by the following trends in 2020 and beyond:

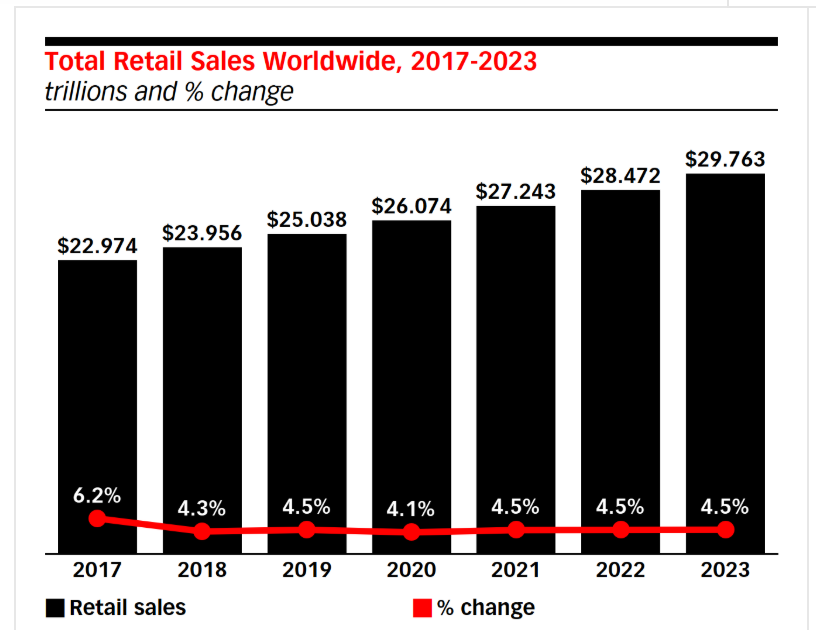

Though the line between physical and digital commerce is blurring, the difference in growth trajectories between retail and ecommerce is still stark (though not as stark as it once was.) Overall, the global retail market was expected to top $25 trillion USD in 2019. However, growth has slowed considerably versus the prior five years and is not expected to pick up through 2023:

Image from eMarketer

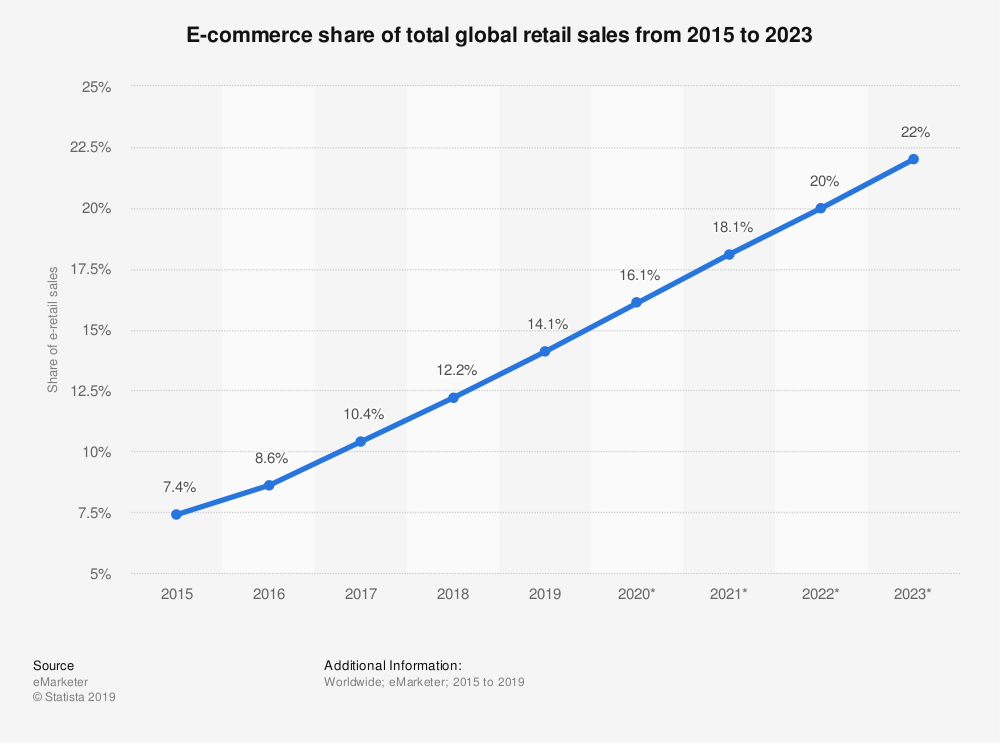

On the other hand, worldwide ecommerce sales topped $3.5 trillion USD, an increase of approximately 18% from the year before. Ecommerce is expected to nearly double by 2023 to more than $6.5 billion. Some perspective is in order though. While ecommerce is growing much faster than retail, it’s still a relatively small piece of the pie. In 2019, ecommerce share of total global retail sales was 14.1% and analysts only expect it to increase 2% a year through 2023:

Image from Statista

Much of ecommerce growth is attributable to Amazon, which is growing at above-market rates and was expected to account for 37.7% of online U.S. sales in 2019. While in-store sales still account for nearly 90% of total retail sales, the total market share of online U.S. retail sales is now higher than general merchandise sales for the first time ever.

With 16.1% of all retail sales expected to happen online in 2020, manufacturers and traditional brands are increasingly bypassing retail partners and selling DTC. In fact, it’s ecommerce growth that is helping legacy manufacturers offset stagnant in-store sales growth.

Selling direct yields three key benefits: You own the customer relationship With a direct customer relationship brands no longer have to rely on retail partners to protect and promote your brand. Establishing a direct relationship with the end consumer also lets you continue to give support after the sale. Collect and use customer data Selling direct lets you collect first-party data that you can use to personalize the customer experience, and ultimately monetize that relationship. Offer personalized products Selling direct positions brands to offer experiences that can’t be had in traditional retail stores. DTC brands are increasingly allowing shoppers to design custom packaging, mix and match custom assortments, or participate in contests while becoming brand evangelists.

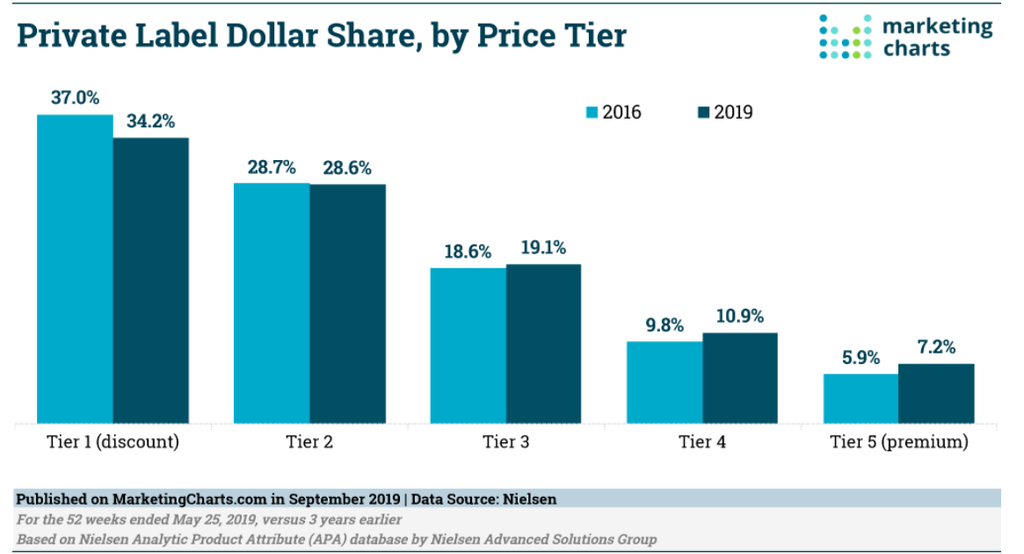

A key driver of the DTC trend is the rise of private-label brands. Private label brands now account for approximately 20% of the consumables market. Driving much of this market share growth are the retail partners on which legacy manufacturers have historically relied on for distribution. They’re increasingly offering their own brands that compete against those produced by legacy manufacturers. Selling direct is a response to increased competition from retail partners offering their own DTC private-label brands. Private-label products are the new challenger brands since consumers are willing to abandon brand loyalty for what they perceive as better value. Importantly, private-label brands are taking share in both online and in brick-and-mortar stores. Nearly one-third of Costco’s sales are private-label, as are 19% of Walmart’s. Importantly, consumers aren’t just turning to private-label brands to save money—they’re turning to premium private-label brands. Premium private-label products, or those that are perceived as higher quality than branded products that sell at higher price points, now account for 7.2% dollar share of US private-label products, up from 5.9% three years ago:

Image from Marketingcharts

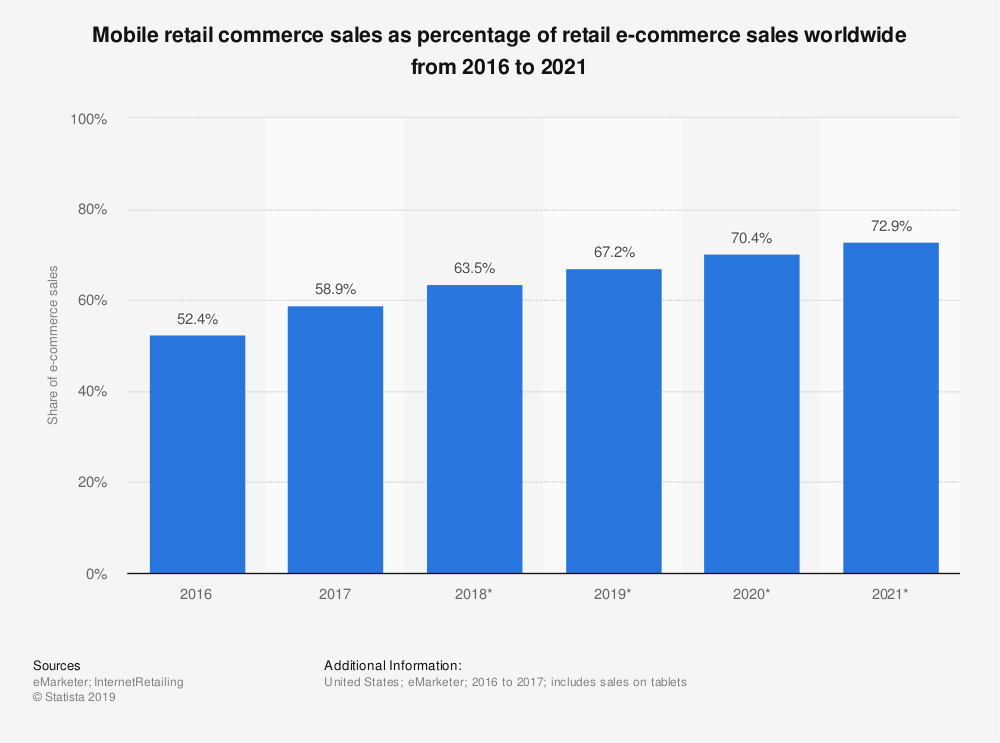

By 2021, analysts estimate 53.9% of all ecommerce sales will happen on mobile devices. Worldwide, mobile commerce is expected to even more prevalent:

Image from Statista

But just because your ecommerce platform theme offers a responsive site doesn’t mean you’re providing a great mobile experience. Mobile conversion rates are less than half those of desktop. Research indicates 53% of consumers will abandon a site that takes longer than three seconds to load. Research suggests mobile bounce rates are 10–20% higher than desktop. To offer an optimal mobile experience across, some brands opt for a progressive web application (PWA), which can live on a user’s home screen and are supposed to load instantly regardless of whether the user is online. PWAs may be part of a headless commerce strategy that lets teams work on the front- and back-end systems simultaneously to further improve mobile performance. Rothy’s, which sells women’s shoes made with recycled plastics, relaunched its mobile site as a progressive web app (PWA):

“Like many other brands, we see the majority of our traffic from mobile devices—a trend that spiked during the holiday season as consumers were away from their desktops,” says Gigi Teutli-Vadheim, Rothy’s Site Experience Manager. “In terms of the customer experience, we’re shifting our focus to be mobile-first and prioritizing speed to ensure users are satisfied.” One step further combining a PWA with an accelerated mobile page (AMP), which are mobile-first stripped down HTML copies of web pages that load instantly. AMPs are the foundation of Google’s mobile-first index, which prioritizes mobile optimization in search results. The combination can yield better search results, more top-of-funnel traffic, and improved conversion rates onsite.

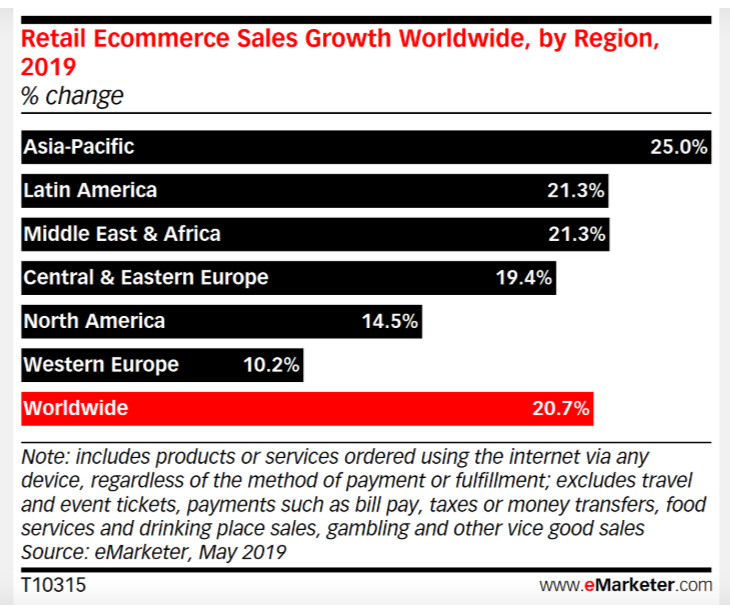

Global ecommerce sales are expected to top $4.2 trillion USD in 2020 and reach more than $6.5 trillion by 2023. More than 2.1 billion shoppers are expected to purchase goods and services online by 2021. Increasingly, these online shoppers live outside the U.S. By the end of 2020, 1.4 billion people are expected to join the world’s middle class, and most of them (approximately 85%) will be in the Asia Pacific region (APAC). Ecommerce as a whole has already shifted away from the West and will continue to do so even as China’s previously hot consumer economy cools a bit. In APAC, ecommerce grew 25% last year, topping $2.27 trillion USD:

Image from eMarketer

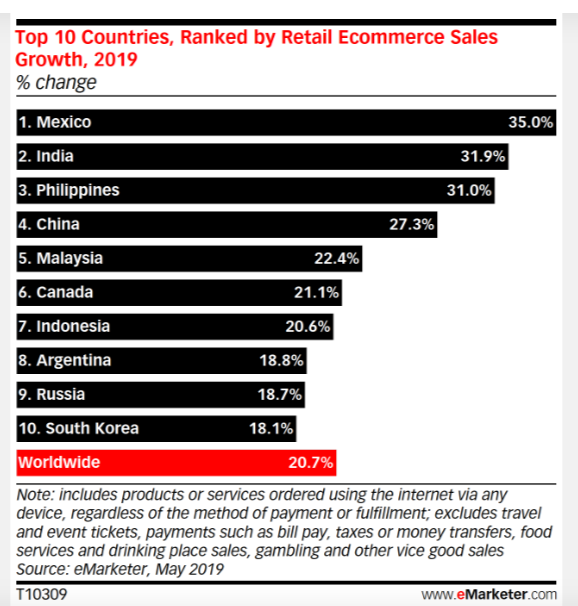

While more than half of the fastest-growing ecommerce countries are from the Asia-Pacific region, Latin America also boasts of accelerated ecommerce growth, including the world’s fastest grower, Mexico:

Image from eMarketer

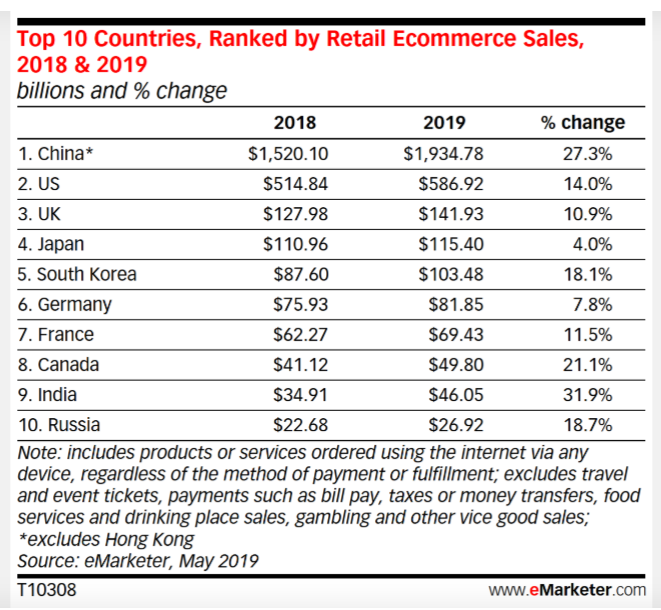

But growth rates only tell part of the story—the king of global ecommerce is China. With an estimated $1.9 trillion in ecommerce sales in 2019, online sales in China are three times that of the U.S. In fact, China’s share of the global ecommerce market is 54.7% or nearly twice that of the next five countries combined:

Image fromv eMarketer

Localization will be increasingly important when expanding internationally. A study by the Localization Industry Standards Association (LISA) found that for every $1 spent on localization, the return on investment (ROI) is $25. Offering customers local payment methods, local currencies, and translating content into local languages is improving the chances of cross-border success.

For example, 100% Pure sells cruelty-free products directly to Chinese customers through Tmall Global and delivers them via a third-party logistics partner. One reason the company quadrupled sales year-over-year, is its decision to localize. Part of its strategy lay in Juhuasuan, a group-buying feature within Tmall for flash sales that also leverages live streams with Chinese influencers. “You don’t want to market in China the way you market in the U.S., so I needed local people to help,” says co-founder, Ric Kostick. “You have to do it the local way.”

Businesses will increasingly put operations on autopilot in the coming year. Automation will be particularly beneficial to brands expanding internationally which requires operating multiple stores and larger inventory and fulfillment networks. On average, international businesses ship to 31 countries, and brands are increasingly using ecommerce automation to scale faster and more efficiently.

Ecommerce automation

Ecommerce automation eliminates many of the manual, repetitive, and time-consuming tasks that reduce productivity. Simplifying cross-border commerce, reducing the risk of human error in managing multiple stores, and offering a best-in-class shopping experience are three ways ecommerce automation is powering productivity: Pre-load storefront changes for major events Rollback those changes automatically Put flash sales and product drops on autopilot List new products on multiple channels Tag and segment customers for retention Streamline tracking and reporting Identify and cancel high-risk orders Schedule inventory alerts for reordering and marketing Standardize merchandising for discoverability Integrate third-party apps to trigger workflows outside your ecommerce ecosystem like email win-back sequences Importantly, ecommerce automation is also protecting brands from a rising threat: fraud. Instead of manually cross-checking orders with shopper purchase histories to determine if individual orders are fraudulent, brands are relying on automated fraud protection natively embedded in their ecommerce platform. Automation can prevent high-risk orders from being fulfilled and prevent costly chargebacks.

Warehouse robotics

Brands operating their own warehouse will increasingly consider robotics to cut costs and become more efficient. Worldwide, there are now more than 3,200 robot-enabled fulfillment centers. Worldwide spending on robotic process automation (RPA) is expected to top $3 billion by 2022. While cost remains a top barrier to implementing RPA, 48% of the businesses that use new technologies like automation expect it to help reduce their workforce.

Artificial intelligence

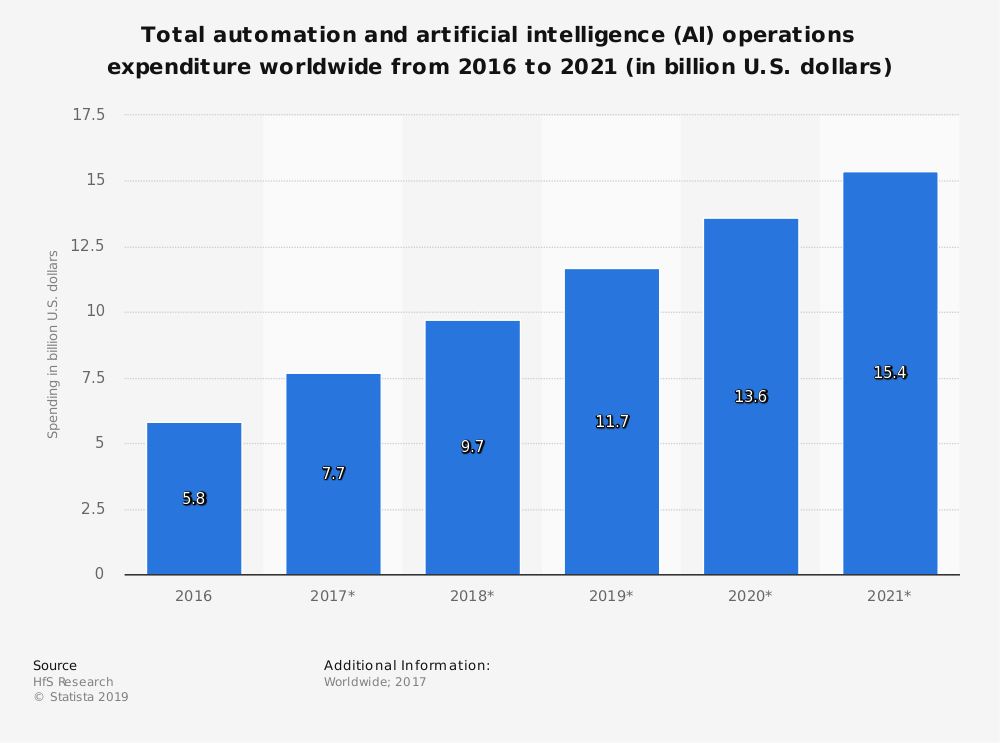

Level 5 automation, or automation that manages itself with no humans involved, will likely require the highest level of machine learning to produce artificial intelligence that can replace human intelligence. Businesses expect to spend big on AI-powered automation. Worldwide AI and process automation expenditures are expected to top $15.4 billion by 2021:

Image from Statista

Consumers increasingly want brands to lead with their values. But aligning your brand with a social cause is no longer enough. Consumers increasingly want companies to act as good global citizens by using green manufacturing practices, eco-friendly supply chains, and reduced waste packaging.

Eco-friendly supply chains

Enterprises are turning to sophisticated technology stacks to cut waste and become more efficient. Smart order routing combined with multi-location inventory, and automated rule-based order routing can match orders with stock in warehouses that are closest to the customer. Automatically routing orders in this manner saves time, expedites fulfillment, and reduces shipping costs. Likewise, consumer demand to know a product’s entire lifecycle also requires the ethical sourcing of sustainable commodities and components. This includes minimizing the impact on the environment as well as treating workers humanely. Big box retailers are asking brands to set goals and measure progress toward reducing annual corporate greenhouse gas emissions. To track this, and other links in the supply chain, Walmart has created a sustainability index for its suppliers. The assessment checks each of their supplier’s commitment to: Create zero waste Use 100% renewable energy Sell sustainable products

Sustainable manufacturing

Energy-efficient and resource-saving manufacturing is just the start. In the future, customer satisfaction is likely to hinge not just on price and quality but how brands manufacture their goods. To realize the environmental benefits of sustainable manufacturing distributed manufacturing systems (DMS) are being considered. These are decentralized networks of adaptable and flexible mini-factories. Putting manufacturing closer to the end consumer reduces emissions by cutting transportation requirements. It can also stimulate regional economies that benefit from jobs produced. Decentralizing the manufacturing process can also improve flexibility and position brands to reconfigure faster if consumer taste or behavior shifts.

Zero Waste Packaging

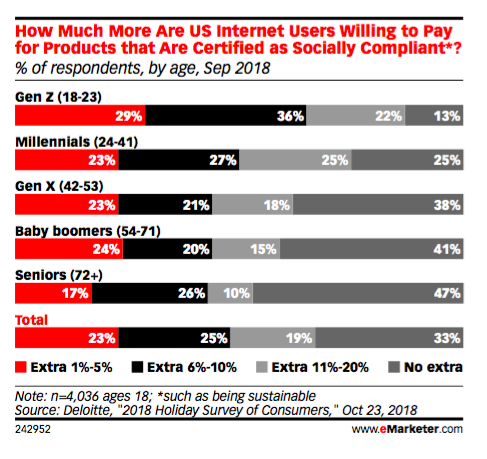

Zero waste packaging is a packaging system where all materials are used, reused, or recycled so there’s no waste product. Driven by consumer demand, it requires that brands do more than simply use sustainable packaging supplies. Besides eliminating waste, the effort requires that all packaging resources be recovered and none burned or buried. Minimalist packaging, reduced package sizes, and redesigned shipping cases are also shaping the future of ecommerce. To reduce packaging waste and its fulfillment costs, Amazon is now charging fees to sellers that don’t comply with its packaging guidelines. Oversized or unnecessary packaging results in a $1.99 charge. The requirements include replacing boxes with flexible mailers, using fully recyclable mailers, and better matching products with appropriate sized boxes. It all sounds costly but could prove lucrative. Research indicates consumers are willing to pay a premium for goods produced in socially compliant ways:

Image from eMarketer

Offering the consumer an experience that can’t be had online will drive digital brands to increasingly experiment with offline experiences. While it may not be a brick-and-mortar renaissance, it does follow in the vein of Amazon Go’s retail outlets in which there are no checkouts.

Mobile retail experiences

Pura Vida Bracelets, a fast-growing maker of handmade string bracelets and accessories, takes an omnichannel approach by bridging the digital and physical worlds. Born online, the brand was built on the backs of social media platforms and has millions of followers and fans. However, Pura Vida recently launched a retail experience through social media that allows consumers to interact with the brand in the real world.

Pura Vida’s airstream trailer not only creates a new stream of revenue, but also lets the brand engage with fans over food, music, and drinks.

Pop-up stores

The Emazing Group partners with the Luxor hotel and casino in Las Vegas for a LUX Rave pop-up experience that spans tens of thousand square feet during 2019’s EDC Week in Las Vegas. To promote the pop-up, The Emazing Group advertises on social media ahead of time:

Swap commerce for experiences

Instead of maximizing sales on Black Friday 2019, sustainable sneaker brand Allbirds closed its Covent Garden location in London, U.K., to tout its commitment to conscious consumption. Branding its offline experience, “Black Friday? We’re Not Buying It,” the Allbirds store may have been closed for retail, but it was open for non-commerce experiences. Consumers were encouraged to stop by for live music, and free workshops like crafting pom poms, and wreath making. The idea stemmed from a desire to educate consumers and prompt them to question how footwear is made. Shifting the focus from discounts to sustainability is a year-round priority for a brand that uses eucalyptus and recycled wool to build products. However, Allbirds didn’t disappoint consumers hoping for new products to purchase. Allbirds dropped three new sneakers exclusive to Black Friday. But by offering an in-store experience of crafting, for example, and a limited run of new products, Allbirds created an immersive holiday experience.

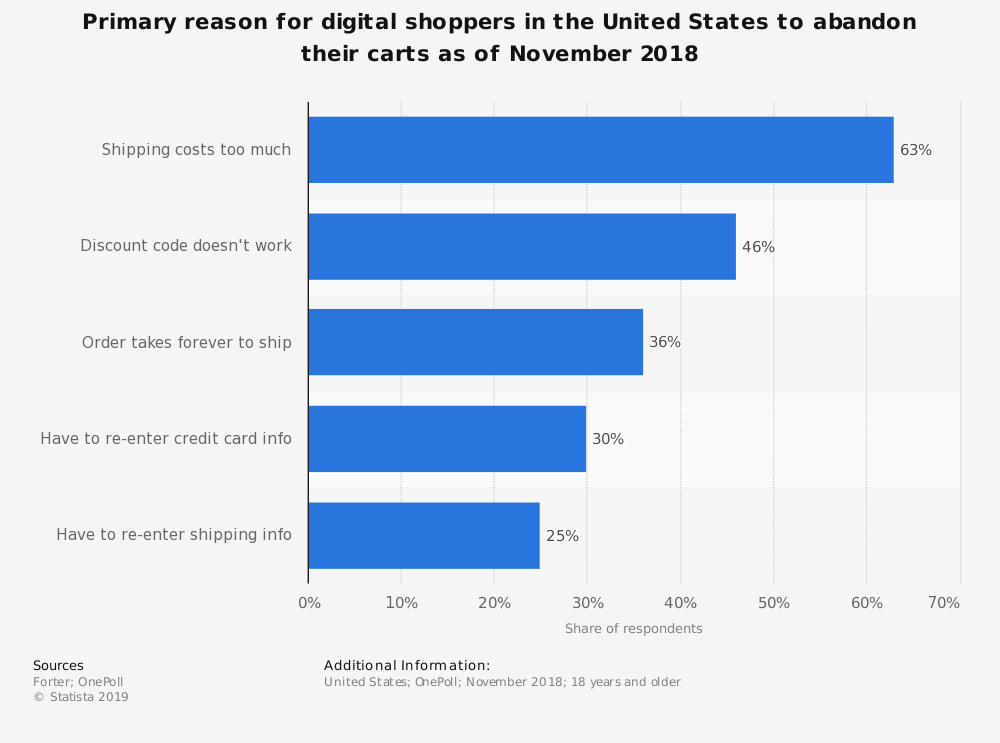

Elevated consumer expectations regarding shipping speed and costs are changing retail. Entering 2020, analysts estimate 65% of retailers will offer same-day delivery, and it’s becoming the norm. Two thirds of consumers say one of the main reasons they abandon digital shopping carts include costly shipping and delayed shipping:

Image from Statista

Like consumer expectations, the costs associated with offering expedited shipping are increasing. For instance, Amazon’s logistics costs, which include fulfillment and shipping, now account for approximately 26.5% of sales. However, this figure was calculated prior to Amazon launching one day shipping. Amazon spent $27 billion on shipping in all of 2018. Accounting for sales growth and the launch of one day shipping, estimates indicate shipping will cost the company $35 billion in 2019. To meet consumer expectations and defray expedited shipping costs, brands are intelligently setting free shipping thresholds to encourage consumers to add more items to their cart, which increases average order values (AOV). Brands are also increasingly relying on inventory management systems (IMS) to avoid stockouts that delay instant fulfillment. Stationing inventory in multiple locations puts merchandise closer to the consumer which reduces transportation time and costs. Brands are giving shoppers more shipping options to cater to those who don’t need their products right away. They’re also displaying cutoff times that clearly illustrate when orders must be placed for different shipping options. This is another reason digital natives are experimenting or partnering with brick-and-mortar retail. Buy-online-pick-up-in-store (BOPS) options can materially reduce shipping costs. Data suggests 68% of consumers have picked up online orders in stores. Don’t expect the trend toward faster shipping to abate as 61% of consumers polled by Afflink want their shipments delivered within three hours.

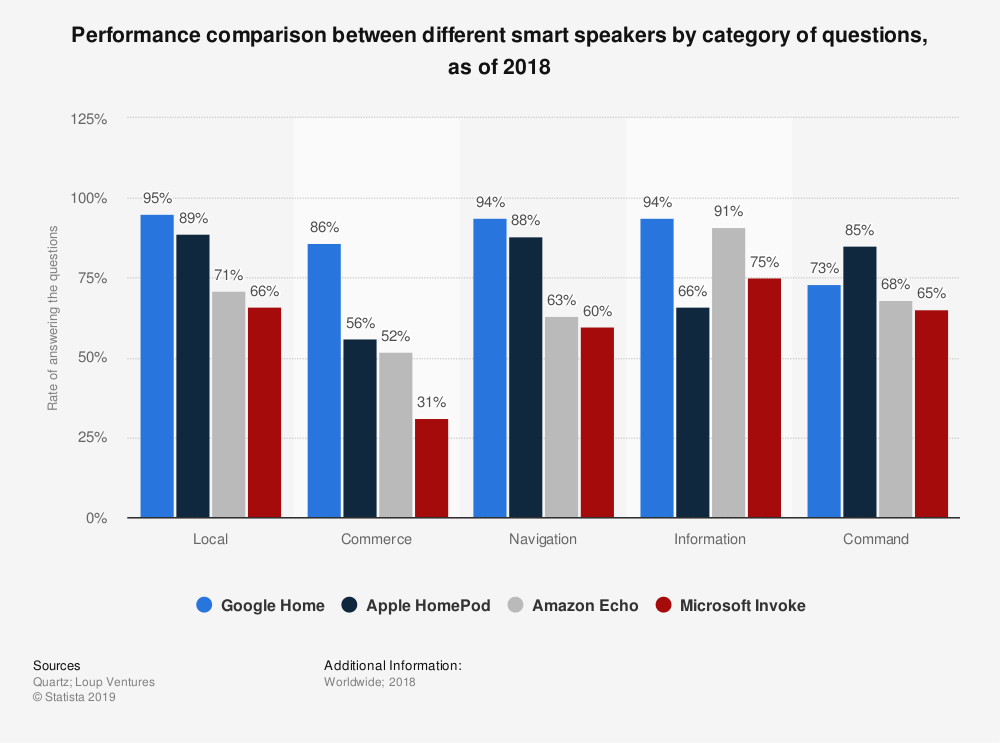

Estimates suggest 35% of all U.S. households are equipped with at least one smart speaker, with many consumers owning more than one. So it’s not surprising that 26.1% of consumers have made a purchase on a smart speaker in 2019. Notice 3.9% of consumers say they buy through a smart speaker daily. Google appears to provide the most accurate responses to questions about commerce, followed by Apple and Amazon:

Image from Statista

While data reveals everyday household items are the most common products to be purchased via voice, buying apparel nearly just as common. Not only does this suggest the path to purchase is increasingly starting via voice, but it also hints that consumers are inclined to purchase more of what they need via voice in the future. In response, brands are optimizing search results to include snippets as 40% of voice results are currently pulled from search engine results snippets. Featured snippets, at least for now, is one way to win the voice search wars. The other way would be to explore the home assistant market with Amazon Echo Dot users. By creating an Alexa “skill,” which are programmed commands like “Alexa, ask Umbrella Corporation what kind of umbrellas are available,” or “Alexa, checkout,” the assistant can search your store for products and even make voice-powered purchases. Amazon will also give you access to anonymized transcripts of user speech data and intent request details so you can better understand how voice is used in the consumer’s path to purchase.

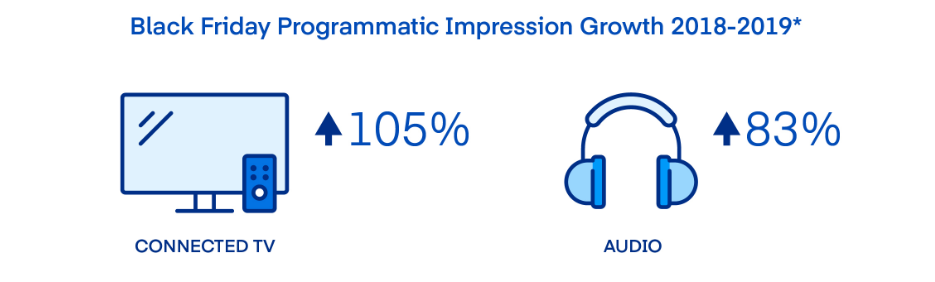

Connected TVs (also known as smart TVs) and audio will emerge as two new hotbeds for advertisers. While Facebook and Instagram will continue to be the bread and butter on which many brands rely, expect significant growth in ad dollars targeting consumers who are streaming their favorite streaming television or music services. The Trade Desk, a programmatic advertising platform, illustrates the momentum new devices and channels have heading into 2020. On Black Friday 2019, the company suggests the connected TV became an essential digital media device for marketers, and audio was not far behind.

Image from The Trade Desk

According to The Trade Desk, the connected TV gives advertisers many of the same data-driven benefits of social media advertising with the added bonus of targeting consumers with highly relevant ads during their favorite streaming shows: Data-driven targeting: Use first- and third-party data to reach your most valuable audiences on every screen–just like with your digital campaigns Better measurement: Track the impact of your CTV campaigns with digital and traditional metrics, including video completion rates and gross rating points Smarter retargeting: Re-engage viewers within households across streaming devices like computers, tablets, and mobile which provides a more comprehensive picture of the customer journey Premium inventory: Run your ads alongside popular TV shows and movies, in front of an audience that’s fully invested

The Trade Desk’s CEO Jeff Green even believes Netflix will soon offer an ad-supported subscription option that would let customers pay less for the service in return for watching a few advertisements. Furthermore, this survey reveals streaming fatigue is setting in among consumers, half of whom say they’re willing to view streaming ads to reduce monthly subscription costs. Expect brands to increasingly bid on high quality streaming ad inventory as part of a well rounded omnichannel approach in 2020 and beyond. The trend may even stretch into the middle of the decade when you consider the many new streaming entrants as well as the expected growth in Connected TV purchases.

Predictions about the future don’t come with probabilities or precise timelines. But the creative destruction happening in retail presents both threats and opportunities, the likes of which merchants have never seen before. You don’t have to seize every trend vying to shape 2020 and beyond. What your customers do expect is that you’ll meet them where they are, providing a valuable customer experience regardless of whether it comes offline, via voice, or the expectation that you operate in eco-friendly ways. Nothing is for certain. But when one channel, device, or big idea in commerce becomes obsolete, expect another to emerge in its place. Retail death loses its sting when merchants realize they can be reborn.